Mergers & Acquisitions in Higher Ed

This summer, I attended my first Society for College and University Planning (SCUP) conference. One presentation focused on Villanova University’s acquisition of Calibrini University (Pennsylvania, USA), and it brought back memories of my own experience as a student when the Technical University of British Columbia (TechBC) was merged into Simon Fraser University (SFU) in Canada.

After the session, I wrote:

In my opinion, Villanova has done a great job honouring the legacy of Calibrini—recognizing students’ progress and faculty/staff years of experience, naming the campus Calibrini, and establishing new centres named after the founders. For those at Villanova, an excellent process was conducted to keep them in the loop and let them be part of the planning process.

Why Mergers Matter Now

Given the fiscal challenges facing both American and Canadian colleges and universities, I believe we’ll see more mergers in the next decade. But there’s an important caveat: in my experience, mergers only succeed when there’s cultural fit between institutions and a genuine win-win for students.

In my own case, SFU worked hard to put students first. Programs in Information Technology and Interactive Arts were grandfathered so students could finish what they started. The Management of Technology program was folded into SFU’s Business faculty, with scholarships offered where additional coursework was required. The result? Students from a fledgling university graduated with the reputation of a globally recognized institution. While far from perfect, the transition was handled thoughtfully. (For more, see Our Time Will Come Again: Tracing the Story of the Technical University of British Columbia.)

Similarly, Villanova appears committed to maintaining Calibrini’s legacy: keeping the campus name, creating an institute focused on immigration, integrating social-advocacy programs, and continuing the Calibrini Scholars program. It’s too early for a full assessment, but early reviews are promising. Their SCUP presentation highlighted the benefits of close collaboration, proactive communication, and combating misinformation during the process.

The Research on Higher Ed Mergers

Mergers and acquisitions (referred to here simply as “mergers”) are increasingly seen as tools to address financial stress, enrolment challenges, and competitive pressures. But they are not without pitfalls.

Challenges:

- Mergers often fail due to neglect of cultural and human factors (Slade, Ribando, Fortner, & Walker, 2022).

- Aligning institutional identities and cultures is especially difficult (M&A Research Centre, 2025).

- Faculty and staff often experience stress, uncertainty, and low morale during the process (Slade et al., 2022).

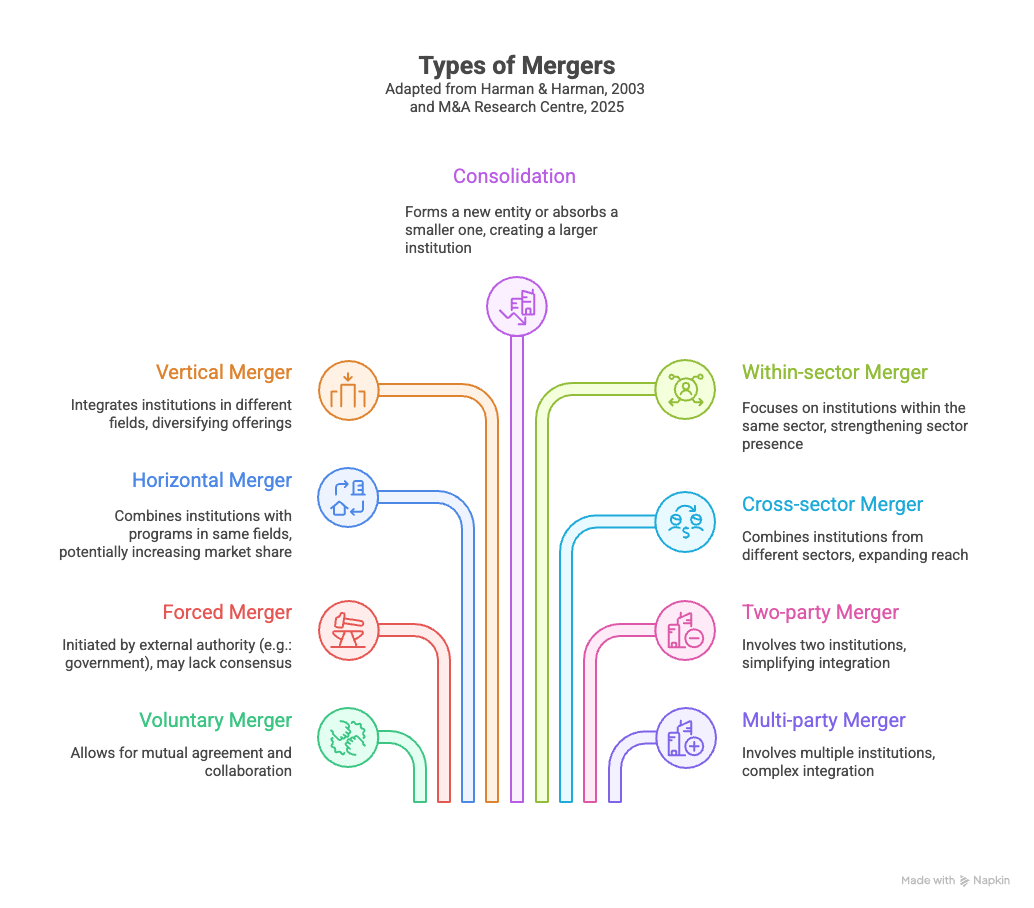

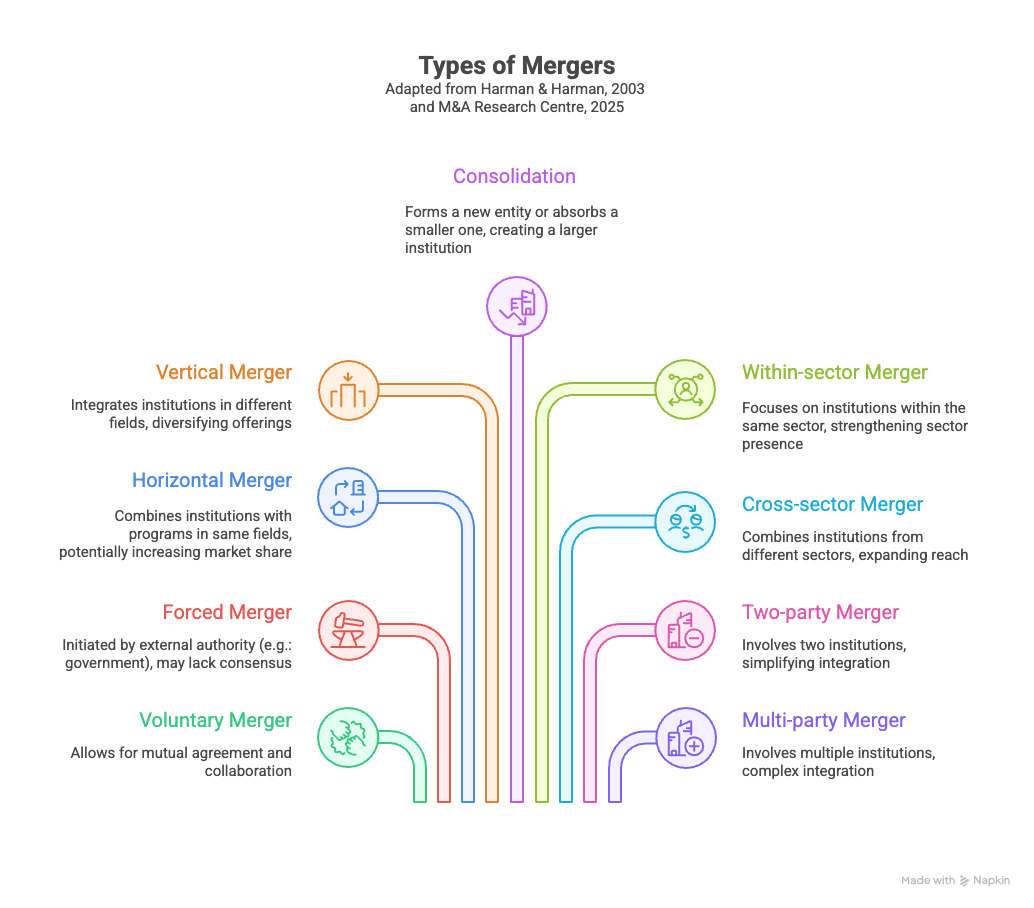

Types of Mergers (Harman & Harman, 2003):

- Voluntary (e.g., Calibrini-Villanova)

- Forced (e.g., TechBC-SFU, initiated by government)

- Horizontal – same field of study

- Vertical – different fields of study

- Consolidation – two or more institutions form a new one, or a large one absorbs a small one (e.g.: University of Manchester and Durban University of Technology)

- Within-sector vs. cross-sector

- Two-party vs multi-party mergers

Evidence suggests voluntary and complementary mergers tend to fare better than forced or consolidating ones (Skodvin, 1999; Wollscheid & Røsdal, 2021).

Not all cross-sector mergers succeed. For example, in Georgia’s university system, mergers of disparate institutions led to consistent reductions in research output five years out (Slade et al., 2022). On the other hand, some mergers have been highly successful: the creation of the University of Manchester and the Durban University of Technology both resulted in significant enrolment and revenue growth (Mergers and Acquisitions Research Centre, 2025).

Why Institutions Merge

Mergers are usually driven by:

- Economies of scale and financial stability

- Strategic expansion and diversification

- Enhanced academic offerings and research collaboration

- Enrolment challenges and competitive positioning

- Political influence and long-term viability

What Makes Them Work

To mitigate risks, research points to several strategies (Slade et al., 2022; M&A Research Centre, 2025):

- Transparent, consistent communication

- Thorough due diligence and planning

- Cultural integration workshops

- Sound financial planning

- Active stakeholder engagement

Final Thoughts

Mergers are never easy. They disrupt lives, test institutional culture, and often meet with skepticism. Yet, when handled well - as in parts of TechBC-SFU, Villanova-Calibrini, the University of Manchester, and Durban University of Technology–they can create opportunities for students and preserve legacies that might otherwise be lost.

My recommendation: Focus as much on people and culture as on finance and strategy. When students emerge better served, the merger can truly be called a success.

Considering merging programs?

Create new enrolment projections fast and give your Deans and Planners a user-friendly way to modify scenarios without compromising the underlying data, overwriting spreadsheet formulas or macros, or adding workload to your institutional reporting office when they want to make a change.

References

Harman, G., & Harman, K. (2003). Institutional mergers in higher education: Lessons from international experience. Tertiary Education and Management, 9(1), 29–44. https://doi.org/10.1080/13583883.2003.9967091

Mergers and Acquisitions Research Centre, University of London. (2025). Mergers in the Higher Education Sector: Implications for the UK. https://www.bayes.citystgeorges.ac.uk/__data/assets/pdf_file/0009/858321/Mergers-in-the-UK-Higher-Education-Sector-final.pdf

Skodvin, O. J. (1999). Mergers in higher education—success or failure? Tertiary Education Management, 5(1), 65–80.

Slade, C. P., Ribando, S., Fortner, C. K., & Walker, K. V. (2022). Mergers in higher education: it’s not easy. Merger of two disparate institutions and the impact on faculty research productivity. Studies in Higher Education, 47(6), 1215–1226. https://doi.org/10.1080/03075079.2020.1870948

Wollscheid, S., & Røsdal, T. (2021). The impact of mergers in higher education on micro-level processes: A literature review. Tertiary Education and Management, 27, 257–280. https://doi.org/10.1007/s11233-021-09074-4